|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Pet Insurance: A Comprehensive ReviewIn today's world, where pets are cherished family members, the concept of pet insurance has garnered significant attention, providing a safety net against unexpected veterinary expenses. With numerous options available, potential policyholders often find themselves navigating a sea of reviews, each with varying degrees of positivity and skepticism. This article delves into the intricacies of pet insurance, offering insights and subtle opinions to aid prospective buyers in making well-informed decisions. Why Pet Insurance? The rationale behind pet insurance is straightforward: it offers financial protection in the event of unforeseen medical emergencies. Veterinary costs have surged over the years, making the prospect of insuring one's pet a practical consideration for many. However, as with any insurance, the true value lies in the details of the coverage, which can vary widely between providers. Common Concerns Among the myriad reviews, certain concerns are frequently mentioned by pet owners. One significant issue is the clarity of policy terms; many policyholders report confusion over what is covered and what is not. This underscores the importance of thoroughly reading and understanding the fine print before committing. Another point of contention is the claims process. Reviews often highlight the ease or difficulty of filing a claim, with some customers praising the efficiency of certain companies, while others express frustration over lengthy delays or denied claims. Coverage Details Understanding the specifics of coverage is paramount. Policies typically fall into three categories: accident-only, time-limited, and lifetime coverage. Accident-only policies are the most basic, covering treatment for accidents but not illnesses. Time-limited policies provide coverage for a specific period or up to a certain monetary limit per condition, which can be beneficial for short-term issues but may leave gaps in coverage for chronic conditions. Lifetime coverage, although more expensive, offers the most comprehensive protection, covering conditions throughout the pet's life, provided premiums are paid consistently.

Subtle Opinions While reviews provide a wealth of information, it's important to read them with a discerning eye. Positive reviews often highlight peace of mind and the value of investment, particularly when a significant claim is paid without hassle. Conversely, negative reviews frequently focus on denied claims and perceived lack of transparency. Striking a balance between these perspectives is crucial for a well-rounded view. In conclusion, pet insurance, like any other insurance product, requires careful consideration and understanding. By examining various reviews and considering personal circumstances, pet owners can make informed decisions that best suit their needs and those of their beloved companions. Whether one opts for basic accident coverage or a comprehensive lifetime policy, the ultimate goal remains the same: safeguarding the health and happiness of our furry friends. https://www.cnbc.com/select/spot-pet-insurance-review/

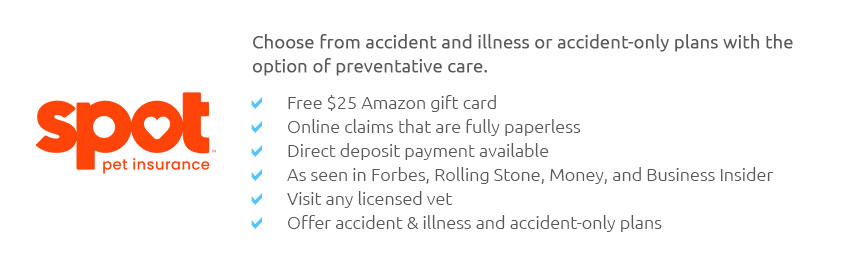

Spot pet insurance offers accident-only and accident and illness policies, as well as two wellness plans for routine care. https://bestfriends.org/pet-care-resources/pet-insurance-worth-it-what-know-about-dog-and-cat-coverage

Talk to family and friends to see whether they are happy with their insurer. Read reviews online. Ask your vet for a recommendation. Obviously, it's important ... https://www.yelp.com/biz/fetch-pet-insurance-new-york

More info about Fetch Pet Insurance - 101 Greenwich St. New York, NY 10006. Financial District. Directions - (866) 509-0163. Call Now - More Info. Hours - From ...

|